The adoption of blockchain technology in real estate has led to a radical transformation of the industry. It has made it easier for people to own digital real estate, allowing people who were previously excluded because of a shortage of resources to participate and hide problems such as a lack of transparency and confidence.

The adoption of blockchain technology in real estate has led to a radical transformation of the industry. It has made it easier for people to own digital real estate, allowing people who were previously excluded because of a shortage of resources to participate and hide problems such as a lack of transparency and confidence.

Real estate has historically been a very illiquid asset, requiring substantial financial investments and drawn-out transaction procedures. Nevertheless, tokenization has changed the situation. Additionally, the blockchain technology that underpins it has enabled previously unheard-of visibility. Having said that, purchasers may now complete deals utilizing tokenized real estate in an immutable manner.

This blog dispels myths about real estate tokenization and addresses pain points concerning its validity, the usefulness of real estate tokens, tokenized rights, and the volume of real estate tokenized. Let’s first look at how fractionalization and tokenization of real estate have affected the industry.

Challenges that Real Estate Tokenization Can Resolve?

The idea of tokenization has the potential to be completely disruptive in the real estate industry. To be fully realized, the idea must operate on a much wider scale. Tokens are nothing more than pointless codes. This is a problem that needs to be fixed immediately.

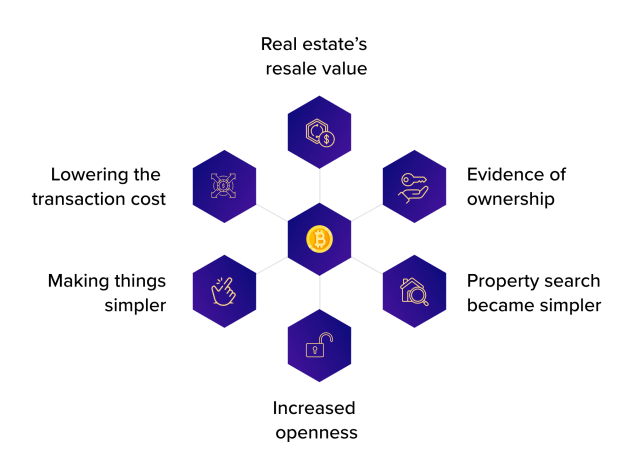

In this context, real estate tokenization can assist with the following issues:

- Real estate’s resale value:

The most significant issue with real estate, which is the asset’s liquidity, is resolved via tokenization.

Tokenization makes purchasing and selling properties easier compared to the conventional method, which involves many participants in the legal asset transfer. It eliminates the middleman and enables ownership transfers from investment to the investor directly.

- Evidence of ownership:

Legal documents that demonstrate the new investor’s ownership rights serve as evidence of legal ownership. In contrast, blockchain technology is voluntarily shared, synced across several locations, and made available to numerous users through tokenization.

All participants receive a quick copy of any modifications made to the ledger. Each transaction is transmitted and verified in order to address any problems brought on by different ownership claims.

- Property search became simpler:

The rapid search for the asset you will invest in is another problem that tokenization addresses. Real estate assets may be listed in a single centralized marketplace if they are tokenized.

As a result, it makes the investor’s job easier because they only have to look in one spot for suitable investments. This prospect will provide buyers with better access to sellers and give investors the ability to explore investment opportunities in various regions of the world.

- Increased openness:

The distributed ledger where real estate tokens are kept not only helps to address the problem by providing irrefutable ownership rights but also enhances market transparency.

By digitizing your assets, you will gain complete protection as well as great transparency.

As was already said, tokenization is supported by blockchain technology; therefore, security is guaranteed because blockchain is a security-proven technology.

- Lowering the barrier to entry for small investors:

The volume of money that tiny investors would invest could not be handled by the conventional system. As a result, there might be an economic loss when marginal expenses exceed marginal revenues.

But with tokenization, the entrance hurdle for smaller investors has decreased because assets are split into smaller quantities and the trades take advantage of the virtual settings.

Additionally, real estate tokenization makes it possible for investors to purchase real estate without having to deal with the difficult legal procedure of transfer of ownership.

- Making things simpler:

Using blockchain technology, trades are cheaper and quicker than with traditional legacy banking systems since there are no intermediaries.

Furthermore, life has been significantly made easier by the possibility of collecting additional tenant payments and disbursing them to real estate token holders.

- Lowering the transaction cost:

Tokenization uses blockchain technology to exchange tokens, drastically reducing transaction costs.

Investors may purchase and sell real estate using these tokens without being required to pay the typical closing charges.

Although REITs provide a comparable value offering, they sometimes have hefty minimum investments and up-front fees.

Models of Real Estate Tokenization

Making tokens containing information about tangible objects and placing them on the blockchain is the process of tokenizing real estate. Individual investors can participate when a property is divided into portions. Any property is capable of being tokenized. It could be a motel, a residential complex, or an office structure.

In addition to conventional tokenization schemes, there are also more complicated ones available, which can appeal to investors even more. Among them, the following can be found:

- Raise-then-Purchase Model:

The transfer of real estate from a person to the company’s balance sheet is one of the main difficulties Stobox consumers have mentioned. This is a somewhat pricey technique, and one answer is to charge investors for it. However, you must first acquire money before leveraging the proceeds from the sale of digital assets to purchase real land.

Getting assurances for real estate purchases and financial attractiveness should be the two main areas of concentration. By coming to an agreement over a specific reserve, the first issue is resolved. The value of the attribute affects the second nuance.

However, the quantity of re-registration will essentially have no impact on profitability if we are talking about really expensive projects costing several million dollars.

- Segregated Portfolio Company Model:

A segregated portfolio for each asset eliminates the requirement for a separate company. There is only one legal entity needed. As a result, costs might be greatly decreased. Risks do exist, though, such as the fact that everything has defects. The company will be compelled to pay dividends from productive real estate assets owned by other investors if one of the properties doesn’t turn a profit.

The accounting information may be divided to fix this issue. In this situation, it is necessary to maintain the balance for each sort of property independently. Tokenization enables the issuance of unique securities for each unique real estate component.

Process of Implementing Real Estate Tokenization

Defining the deal type and the legal framework are the first two elements in the real estate blockchain-based process.

Choosing blockchain technology for token storage and a marketplace where investors may safely buy digital products after checking KYC and AML criteria are the next steps in the implementation process.

- Deal Structuring:

Early on is when a number of factors, including asset type, shareholder type, jurisdiction, and pertinent legislation, have a significant influence.

Issuers frequently decide to tokenize a current offer to provide liquidity for current investors before raising capital to launch a new venture.

The owner of the asset decides which specific attribute or qualities should be converted into digital form.

- Digitization:

During the digitization step, the ownership data written down on paper is transferred to the blockchain. Smart contracts are used to encrypt certain actions, and security tokens are kept in a distributed ledger. To securitize and construct an investment vehicle, a legal wrapper around each individual property is required; this is a stage in the process of digitizing real estate.

The most typical structures include:

Real Estate Fund: The token represents the units of a real estate investment trust, which makes investments in a group of assets. Only accredited investors or authorized institutional buyers are permitted to borrow against profits received from tokenized investments.

Real Estate Investment Trust (REIT): Holders of tokens have the same access to a REIT’s operational revenue as current investors. In a REIT, investors can create interactive shares.

Project Finance: Money may be raised for projects quite effectively using tokenization. At this event, tokens may be bought by accredited investors as well as by consumers. In this scenario, the token might represent ownership or a possible right to use.

Single asset Special Purpose Vehicle (SPV): Each token investor must register as a member of the LLC before investing in order to comply with KYC/AML standards for LLCs and provide investment shares of the SPV under such a structure, which is often a series LLC.

- Technology Selection:

Selecting the appropriate technology comes after deciding on the legal framework. Four decisions must be made during the process:

Selecting Blockchain / Token: This entails selecting the blockchain around which the token will be stored, determining the token standards to be applied, modeling the token data, and writing smart contracts to set transfer, limit, commission, and other regulations.

Primary / Secondary Marketplace: Deciding how the initial tokens will be created and distributed during the initial offering and establishing the locations and procedures for token trading with investors.

Custody: Putting in place a safe custody process for real estate, with regular upkeep and reporting of current events.

KYC/AML: Periodically confirming that investors are in line with the law.

- Distribution and Marketing:

The generation and circulation of tokens are the main topics of this phase. Numerous payment options, including cryptocurrencies, stablecoins, monetary systems, and others, are accepted for the acquisition of digital real estate tokens. Investors will want a digital wallet that is accessible mostly on the web and through real estate mobile to keep their real estate tokens. Investors can acquire these real estate tokens at a live auction.

Primary Distribution- This process trades investment capital tokens for investors and stores their information on the digital ROM.

Post-Tokenization Management- It involves methods for controlling aspects of the company, such as shareholder voting and dividend payments. These procedures may be automated using decentralized applications that are written into the token. Following tokenization, management will continue until maturity or redemption.

Secondary Trading- The advantage of tokenization in boosting liquidity is recognized in secondary trading. Therefore, a property investment token owner can exchange tokens with that other investment over the counter or on a stock market.

- Post Support:

The developer of real estate software also offers extra assistance to investors, such as assistance with legal concerns, continuous monitoring of all real estate token holders’ actions, assistance with mortgage concerns, and the creation of a corporate code. We rely on you to be conversant with the whole tokenization procedure for the real property asset.

Benefits of Real Estate Tokenization

Tokenization has the capacity to radically transform the global real estate market. It offers both issuers and investors a wealth of substantial advantages over the existing investment options, as well as opening up opportunities for a bigger number of investors to enter the market.

Real estate tokenization offers a number of benefits that enable it a far more effective investment alternative than anyone that has gone before. Here we have defined the key benefits of real estate tokenization.

- Fractionalization:

By dividing up valuable assets into tokens, tokenization lowers the entry barriers to investing and opens up the market to a larger group of international investors.

- Operational Efficiency:

The automation of many processes, such as investor whitelisting, regulatory inspections, and post-issuance activities like dividend distribution, is made possible by “smart contracts,” or configurable activities on the blockchain.

- Flexibility:

Since tokens are simple to buy and sell, investors have more control over how they manage their daily exposure to a certain class, area, or kind of real estate. They are able to successfully lower the risks in their portfolio thanks to this.

- Reduction in Fraud:

Blockchain-based transactions provide irreversible records that are saved digitally and therefore cannot be altered.

The tokenized digital asset may include information, rights, and constraints pertaining to the underlying property embedded in it. Anyone who would like to see all of the earlier occurrences may do so.

Real estate buyers now have greater faith and confidence as nothing more than a result of tokenization.

- Reduced Settlement Time:

Compared to conventional financial transactions, tokenized goods transactions can be settled more swiftly by investors.

Tokenized transactions may be completed instantaneously, as opposed to regular transactions, which may take weeks or days to complete.

Future of Real Estate Tokenization in Real Estate Assets

The market environment is changing quickly as a result of the tokenization of property assets. Access is now open to all investors, not just wealthy investment organizations. Asset owners can better manage their equity, and investors can transfer their money around more effectively. Numerous additional arguments in favor of real estate tokenization will demonstrate why it is the way of the future for real estate assets. Firstly, the important ones.

- By assuring improved market transparency, dependable ownership monitoring, increasing liquidity opportunities, and enabling real-time investment procedures, it improves the traditional real estate sector.

- Real-time exchange of real estate tokens creates new opportunities for ambitious and inventive real estate enterprises.

- Real estate tokenization is competitive with other well-known forms of financing like venture funding and leveraged buyouts.

- In Europe, the United States, and some parts of Asia, the technological and financial aspects of tokenization have been successfully managed.

- In the following five years, tokenization is predicted to generate $4.2 billion in income for the international real estate sector.

These arguments demonstrate the viability of real estate tokenization. Compared to the conventional paradigm of dealing with estates and investors, this procedure offers greater flexibility, security features, and spectacular adaptability.

Why Choose Quytech to Build Real Estate Tokenization Project?

For companies to get a competitive edge, Quytech, a well-known real estate app development company, offers high-end apps related to real estate tokenization or blockchain-based applications.

Additionally, the one-of-a-kind solutions we create are tailored to Quytech’s demands and those of its clients, and they are intended to bring about real improvements in terms of customer satisfaction, operational effectiveness, and growth.

Not yet convinced?

Quytech has a team of highly dedicated developers in India with years of expertise in developing real estate mobile applications.

Also, don’t be hesitant to get in touch with Quytech in order to understand how we can increase the productivity and sustainability of your real estate or blockchain-based business.

Wrapping Up!

To sum up, even if it wasn’t as easily available as it is now, real estate has long been a sought-after investment. Real estate assets are now more affordable for small-scale investors thanks to their tokenization. After tokenization, those who were discouraged by real estate’s high prices can now invest owing to the low pricing.

Additionally, you may anticipate that the rate of tokenization will quicken as regulatory obstacles improve over time and cryptocurrency enters the mainstream. Real estate tokenization for commercial and residential properties could have various regulatory constraints and varied applications for the underlying technology. For stakeholders throughout all corners of the spectrum, life could get simpler.